A BRIEF HISTORY OF VETS REPORTS

Ariella Kuhl|September 24, 2018|Audit & Compliance

|

VETS-4212 reports are due September 30th and with the deadline quickly approaching, it is a great time to evaluate your company’s compliance strategies to ensure that your organization is keeping up with all federal deadlines. Just as important, is to understand the history of these reports and the importance of their data. In this week’s blog post, we will walk you through a brief history of VETS reporting and tips for how your organization can succeed in complying.

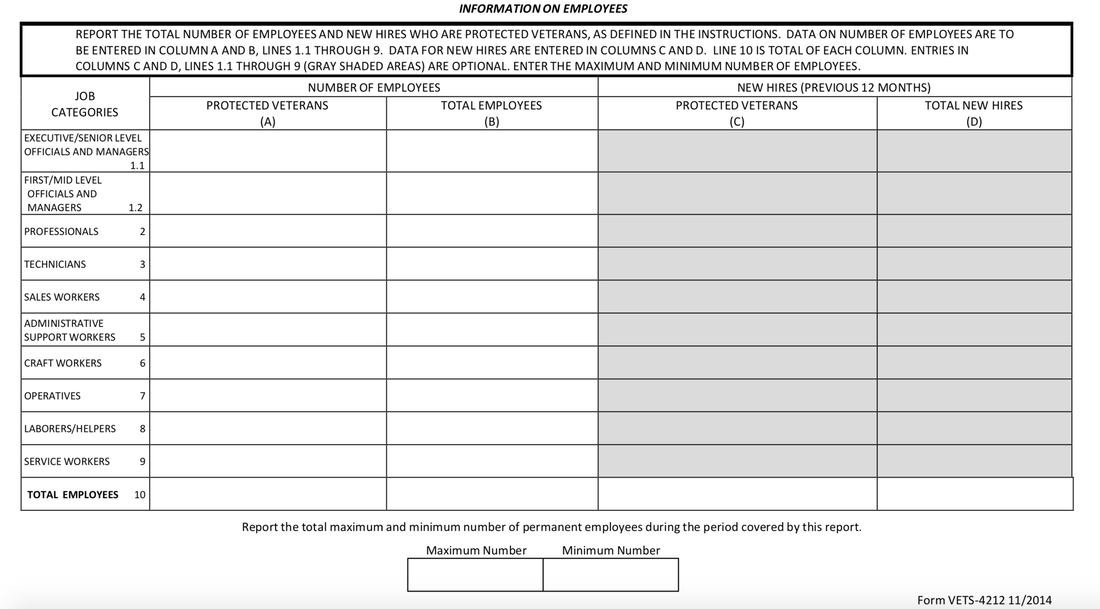

VETS 100-100A reporting was created by the DOL under the Vietnam Era Veterans Readjustment Act (VEVRA). The VEVRA requires government contractors and subcontractors with a contract of $100,000 or more to fill out VETS 100-100A reports. Generally, these reports contained important information regarding veteran employment history. The covered veteran categories for the VETS-100 form included special disabled veterans, Vietnam era veterans, recently separately veterans and other protected veterans. The veteran category for VETS-100A form included disabled veterans, other protected veterans and Armed Forces Service Medal veterans. In 2014, the Department of Labor published a final rule that changed the VETS-100A Report and renamed it the VETS-4212 Report, getting rid of the VETS-100 Report all together. The greatest difference between the VETS-4212 and VETS-100A report is that now contractors only have to report general protected veteran employment numbers (as opposed to each specific category listed above in the VETS-100 and VETA-100A forms). The DOL published this final rule to reduce the amount of time and money contractors would spend filling out the detail-oriented VETS paperwork. Starting in 2015, VEVRA also made another change to the rule that now requires government contractors to submit VETS-4212 forms only if their contract value is over $150,000, as opposed to the previous $100,000. For more information on the logistics of VETS reporting, visit https://www.dol.gov/vets/vets4212.htm. The data provided in these VETS reports shares valuable information about your organization. Therefore, it is important to understand these reports and the filing process: HELPFUL INFORMATION:

Contact Center (DOL-NCC) 7425 Boston Blvd Springfield, VA 2215 Finally, we suggest completing your VETS-4212 reports with as much advance as possible to allot time for revisions. If your organization is struggling to manage VETS, EEP reports, or other crucial government deadlines, and/or have any questions regarding your paperwork, Marroquin Consulting, US will guide you through each step of the process. We specialize in creating customized calendars and strategic plans to ensure that your organizations is compliant. Visit www.marroquinconsulting.com to learn more about our complimentary 1 hour compliance assessment or contact us to learn about our services. info@marroquinconsulting.com; 1-833-477-8384. |